You’re about to launch your new store and now you are trying to decide which eCommerce payment options you should offer. Maybe you have been selling online for years but now you’re evaluating which options may improve your conversion rate or save you money. While it can be a simple choice, it is well worth it to take a deeper look at your options to make sure your choice is well-suited to the needs of your business.

The three major choices for accepting payment

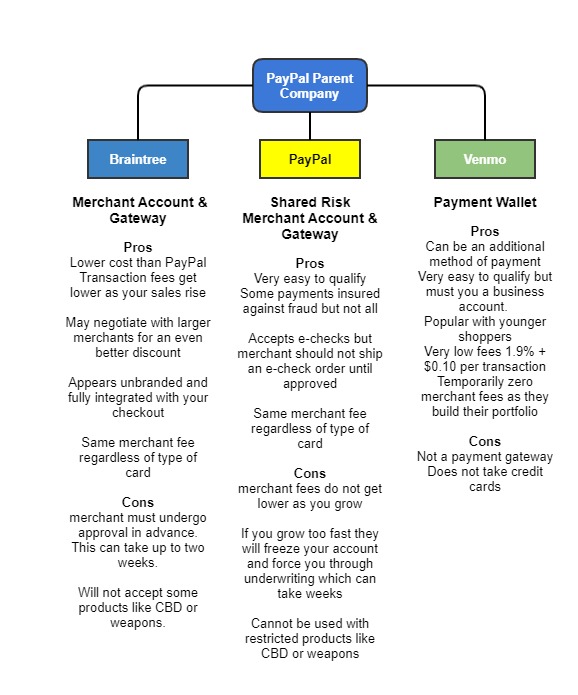

Let’s talk about PayPal. This is a great place to start the balance of this article as PayPal is the only company that currently offers all 3 primary forms of payment processing – gateway plus merchant account, shared merchant account, and payment wallets. Note PayPal, as PayPal, is both a shared processor and they offer a payment wallet for shoppers. Braintree is a gateway that works in conjunction with a dedicated merchant account.

PayPal Payment Options for Merchants

Gateways, shared gateways, and payment wallets

All stores need a way to accept credit cards, debit cards, and prepaid cards. There are two primary types of accounts that can be used to accept credit cards. A shared merchant account and a dedicated merchant account.

Some core terminology you will see below explained:

- Gateway – this is really a bridge that connects your store to a merchant account.

- Merchant account – this is a specialized bank account that processes your credit card transactions. This is different from your business’ bank account. Usually, stores transfer settled payments in their merchant account to their business bank account.

- Underwriting – this is an investigative process where the merchant account bank will want to know more about your business to assign an expected risk level that may influence whether or not they will accept your business and what rates they may charge you.

- Chargeback – this basically means the bank behind a specific credit card transaction has rejected or challenged a charge. This can be due to a customer error or legitimate fraud. You should pay attention to chargebacks as they cost you money and can cause you to lose your ability to accept credit cards for payment.

- Fraud rates – if you get a lot of chargebacks most merchant accounts will close your account.

- High-risk products – some categories of products are considered to be higher risk than most. As a result standard processors won’t accept merchants who sell them. Many processors also have morality codes that can influence whether or not they will accept a merchant. If you sell these types of products, you may need to seek out a merchant bank that welcomes your merchandise. Among the types of products that may need a specialty merchant bank: CBD, drug paraphernalia, sex toys, weapons, some supplements, and pharmaceuticals.

Shared merchant account

As shown above, these accounts are a “one-piece” option that provides a combination gateway and merchant account. The most commonly found within the US are PayPal, Square, and Stripe. All you have to do to use them is to open an account and you can accept payments.

There is no advance underwriting as these are “shared-risk” accounts. This means they compute an average level of risk for all accounts. If your store begins to rise above this level, they may ask you to undergo an underwriting process and will freeze your access to any funds on account while this happens. We recommend that you do frequent bank transfers to minimize the amount that may sit in your account.

Shared merchant accounts are an excellent option for small merchants but are generally neither flexible enough nor priced low enough for larger merchants. The shared risk aspect can also make them a poor choice for larger merchants. This type of account is generally restricted from accepting high-risk products as well. Most do not have a monthly fee.

Gateway plus a dedicated merchant account

In order to accept credit cards at all, you need a payment gateway as this is the technology that manages the actual transaction. Some gateways can be connected to many merchant accounts and some can accommodate multiple merchant accounts although most stores need only one merchant account. Some may offer additional features such as credit card vaulting (storing number for future use), the ability to accept an e-check, or offer cash on delivery.

As you grow in size, the ability to separate the merchant account from your gateway becomes an advantage as you can negotiate better rates. It’s also possible that you have a significant offline revenue channel, or channels, such as a retail store or wholesale business that you’ve already negotiated lower rates than the shared gateways, or shopping cart default offering.

Credit card processing rates can vary significantly depending on your volume and the risk profile for your business. A savings of even half a point can add significantly to your profitability. If you are over $1 million in sales, it is time to look around.

One caveat here, most processors charge more for premium award cards and American Express (AMEX). Some do not. If your client mix has a lot of these cards, it may end up cheaper to use a merchant account that averages this out. Some popular gateways include Authorize.net, Cybersource, Braintree, and Ayden. There are many gateways. In most cases, you’ll want to choose one that already connects easily to your shopping cart. Custom integrations can be done but due to security requirements, may be expensive to implement.

Do the math. Another consideration, some will have a monthly fee and some do not.

Why might you want more than one merchant account?

Usually, this is done for one or more of a few reasons. First of all, to spread the risk. Any form of merchant account can be frozen (temporarily) or even closed. This usually happens because your chargeback rate is too high. If you’re dependent on one account, you’re now in trouble because you can’t process credit cards.

Another common reason is that you’re doing multinational business and wish to better manage exchange rates.

If these situations represent your business, then you may wish to discuss your needs with a broker who can help you find the best banks for your specific business needs.

Default recommendations for credit cards by platform

On BigCommerce the default payment recommendation is Braintree by Paypal. This is a gateway and dedicated merchant account. However, this differs from the standard Braintree offering which allows you to choose another bank for your merchant account. Braintree is also the bank in this instance.

Braintree offers fixed rates that vary depending on which BigCommerce plan you are on with the lowest rate of 2.2% for stores on the enterprise plan. This rate covers all types of cards including AMEX. If you’re getting better rates via another processor and you’re at least $1 mil a year online, check with them to see if they will match another rate.

All stores using a dedicated merchant account will need to undergo underwriting before the account is truly active. This can take up to two weeks so plan for this time.

On Shopify, the default payment recommendation is Shopify Payments. This is actually a shared merchant account so there is no requirement for advance underwriting. Shopify Payments is powered by Stripe and holds to most of the same rules. It does vary from Stripe in a few ways including being available in fewer countries. Rates are competitive with stock Braintree rates.

One negative on Shopify is that if you wish to use a different payment processor as your default credit card processor, or are unable to use Shopify Payments, Shopify will assess a fee equal to .15% up to 2% of your total sales to offset the lack of income Shopify makes when you use their payment service.

Mobile Payment Wallets

Most stores also offer a choice of digital wallets. Payment wallets are quite handy as they can make checking out faster for the shopper and offer better protection for their personal data and credit card information.

Popular payment wallets include:

- PayPal

- Amazon Pay

- Apple Pay

- Google Pay

- Chase Pay

- Masterpass

- ShopPay (requires the use of Shopify Payments)

- Bolt (only available to stores doing more than $3 million per year)

- Venmo (must be business Venmo account)

We do recommend stores offer some wallets. PayPal is the most popular. We also recommend testing to see what works best with your audience.

Offering too many choices can actually hurt conversion rates so try to stick to no more than 3.

Credit options

One way to help increase your average order size is to offer payment terms. There are many services that offer either a Pay-in-four at 0% interest to the shopper or full credit terms.

What is really nice about these services for eCommerce is that the credit provider assumes all credit risk. What this means is that you get paid in full even if the customer doesn’t make all their payments. They do charge a higher fee than a standard credit card processor so compare. Some are also easier to use than others.

Among the more common options: PayPal Credit and Pay in Four (new), Affirm, Sezzle, and Klarna.

Subscriptions

Some products lend themselves well to repeat purchases at regular intervals. If this fits your stores’ profile you may also wish to consider options that allow you to accept subscriptions. This is generally not your primary payment gateway through Shopify Payments may soon accept subscription billing.

There are many companies that offer to extend subscription billing to your store. They can differ quite a bit in how they work as well as their fee structure. Some are fully integrated with your existing checkout. Others route customers to a different checkout altogether.

One key consideration if your catalog includes both subscription and non-subscription offers is that some of the popular subscription options cannot handle both in a single transaction.

Fraud prevention

Where there is a potential for financial gain there are always criminals who will try to take your hard-earned money. Credit card fraud is rampant. Not all stores will see a big problem but if you sell items that are easy to resell, it may be a real risk to your business. If you sell any form of electronics, expect fraud.

The worst part is that a criminal ring will often send a few smaller orders to see if they can get approved. If this is successful, they will launch a full-fledged attack and you’ll see a lot of fraudulent orders.

It used to be fairly easy to spot fraud but criminals have gotten more sophisticated and the usual measures such as an address match and CVV match are no longer signs that an order is legitimate.

While we do recommend you do some research on a suspicious order, you won’t be able to do reliable fraud-screening yourself. You’ll need software to help protect your business. Since this is a large topic on its own, we won’t get into those details here. If you have concerns about fraud, reach out to us for some recommendations.